The Benefits of Investing in Mutual Funds

A fantastic method to watch your money increase over time is through investing in mutual funds. Because they pool money from several different investors, mutual fund managers invest on behalf of the whole group.

This means that you will usually get a higher return than you would get just by investing directly in individual stocks.

However, not every company is right for every fund. Therefore, it’s important to understand what kind of fund is appropriate for your situation and financial goals.

Not only do investing in funds give you access to different securities, but they also enable you to diversify your portfolio beyond stocks and bonds or into alternate investments such as real estate or private equity investments outside of the stock market, like venture capital firms and hedge funds.

If you’re looking for ways to safely grow your savings without exposing yourself too much to risk, mutual fund investing in navi mutual funds might be right for you!

Table of Contents

What are mutual funds?

Mutual funds are pools of money purchased and held together by a manager’s efforts. Investors benefit from the manager’s expertise through the dividends the fund pays out to shareholders. This is why mutual funds are often referred to as “vanguard funds” since they are run by professional managers who are incentivized by sharing in the returns of the fund they manage. Unlike stocks, you don’t own any shares of a mutual fund. Instead, investors in a mutual fund own shares in a corporation that owns shares in the fund. The managers of the fund choose which securities or assets to include in the fund and to whom they will distribute the profit.

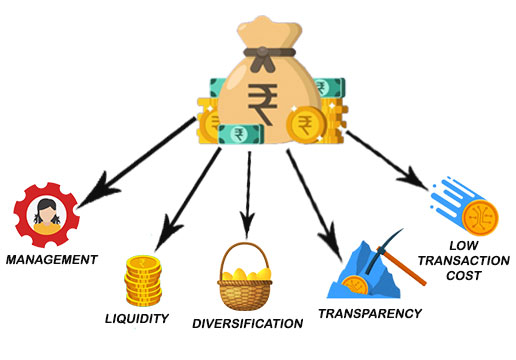

Mutual Fund benefits

Long-Term Growth – Investing in a mutual fund is a good way to grow your money over time. You don’t have to try to pick individual winners like you would when investing in stocks. Instead, you can take advantage of the fund manager’s expertise and let them decide which investments to make for your fund.

Low Fees – Compared to stocks, mutual funds have low fees. This is because they don’t have to pay the costs of buying and selling stocks, like brokerage fees and bid/ask spreads.

Access to a Variety of Investments – Mutual funds may help you diversify your portfolio by adding more assets to it than stocks and bonds, such as property investments or private equity investments made outside of the stock market, such as venture capital firms or hedge funds. Mutual fund investing could be beneficial to you if you’re seeking strategies to build your assets safely without taking on too much risk.

Conclusion

If you want to build your money over the long term and don’t want to take on a lot of risks, investing in navi nifty 50 index fund in a mutual fund may be a smart choice for you. Even though it’s a risky investment, it’s important to keep in mind that many of the largest stock market historical disasters came with times of significant equity market returns!